Strengths

- The globalisation of internet access and market penetration opportunities are accelerating because of the physical distancing linked to the COVID-19 pandemic

- Exponential growth of connected goods

- Strong innovation, with AI having a growing impact on all sectors and future 5G technology

Weaknesses

- Saturation of some hardware in large markets (tablets, smartphones, PCs)

- Long-term challenges regarding rare mineral reserves

- Tougher regulatory environment in the future for ICT giants, notably in terms of taxes, data protection, freedom of speech and CO2 emissions

- Concerns about semiconductors shortages and supply chain disruptions

Risk assessment

Risk Assessment

Empirically, the boundaries are increasingly blurred between the product and service ranges offered by ICT companies and the firms’ traditional business activities.

The pandemic still affects the different segments included in ICT to various degrees, even though it continues to remain one of the most resilient sectors overall in the context of this crisis. Following a stronger recovery of global GDP in 2021 (+5.5% in 2021 according to Coface) and concerns about the supply chain disruptions, all segments should remain resilient. Coface expects a global GDP growth forecast of 4.1% for 2022. The media segment continues to benefit from the mobility crisis induced by the pandemic, generating strong demand and inducing an increase in production. The telecommunications and electronics segments are expected to gradually recover, albeit with disparities between regions. In fact, the aforementioned segments have experienced weaker activity due to semiconductors shortages and a robust supply is expected from end-2022, as chip companies are working to increase the supply.

In addition to the management of shocks resulting from the pandemic, challenges that the sector faced before the COVID-19 crisis remain. On the one hand, international trade and supply-chain tensions are increasing and are continuing to focus on technological issues. On the other hand, projects to introduce laws that aim at being more restrictive (notably towards the “Tech giants”) in terms of data protection, taxation, freedom of speech and CO2 emissions are still underway.

Notes for the reader

Coface’s sector assessment methodology for the Information and Communication Technologies (ICT) sector incorporates several segments: telecommunications, electronics, media and a final segment comprising computers, software and IT equipment.

WORLD SEMICONDUCTOR TRADE STATISTICS (WSTS): The WSTS is a professional organisation, whose members are key companies in the global semiconductor industry. It is an international reference organisation for the production of statistical data on the semiconductor market.

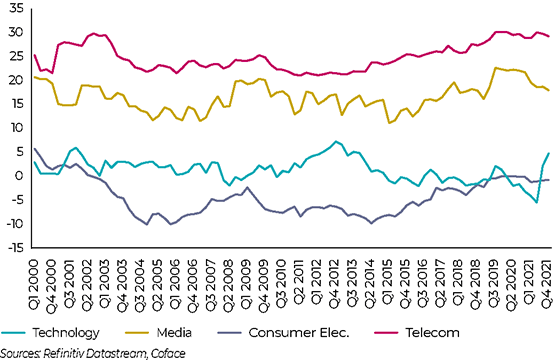

NET DEBT RATIO OF THE DIFFERENT SEGMENTS OF ICT SECTOR (%)

Sector Economic Insights

The media segment continues to remain robust in 2022

The mobility crisis generated by the pandemic continues to benefit the media segment, as opposed to other segments of the ICT sector. In 2022, we expect another year of strong media growth driven by the economic recovery, new product offers and higher advertising intensity across multiple sectors. The videos (games), ePublishing and Music medias’ components will continue being enhanced. The gaming segment will benefit from substantial revenues in 2022, as new generation video games consoles (PS5 for Sony and Xbox Series for Microsoft) will be again widely available for sale thanks to component supply. Major companies such as Sony and Microsoft will provide advanced services and new game titles are expected to be released. Indeed, the majority of segments are still affected to a large extent on the supply side - depending on the different regions of the world - by chip shortages and supply chain disruptions. Moreover, businesses continue to invest and promote digital transformation.

Even if the pandemic-related restrictions are lifted and the share of people fully vaccinated worldwide exceeds 46% by the end of 2021, interest in new media continues to rise, especially the supply of entertainment (leisure activities such as streaming), resulting in an increase in demand. Because of this strong demand, supply has been vigorously stimulated and production has increased. Coface expects demand to remain dynamic, given an environment in which authorities in different countries around the world are expected to continue to promote teleworking, whenever possible, as well as social distancing, particularly if there are renewed periods in which the level of contamination rises due to concerns of the existence of new variants. This context, including teleworking, continue to accelerate changes in lifestyle and work habits, which should maintain the demand for these types of products in the long-term.

Challenges for the telecommunications, electronics and computer hardware segments are expected in 2022

Despite the current chip shortages, the global semiconductor supply is expected to grow by 8.8% in 2022 and will continue to outperform due to strong pricing power, according to the WSTS report. All product categories, but mainly the Sensors and Logic category (smart watches, gaming headsets, specific applications in smartphones, car and consumer electronics) will experience positive growth rates due to a rise in demand and interest in innovation, advanced products and digital transformation. Due to substantial investment in 2021, all regions are expected to experience supply growth in 2022 leading to an imbalance between supply and demand. Investments in digital infrastructure such as the optical fibre, 4G/5G, and data centres are supposed to increase.

The telecommunications, electronics and computer hardware segments are therefore supposed to remain resilient and keep improving, with a gradual recovery in supply due to large investments ignited by governments (especially in advanced economies) to diversify the global chip supply chain, and to shorten the distance between production and consumption. However, the industry will remain dependent on Asia for sourcing, as the region established itself as a hub for key electronic components.

Furthermore, we anticipate a growing number of partnerships between telcos (telephone companies) and large companies on 5G networks for industrial use cases in 2022. One of the main actors, Amazon Web Services (AWS ), announced in December 2021 a private 5G managed services for its cloud partners and clients. We expect a greater operator activity in digital healthcare and related solutions over 2022 and telemedicine will remain relevant over the near-term, thus presenting a lasting lucrative opportunity for operators.

Moreover , demand should remain dynamic in Asia. In this context, the propensity to spend on electronic equipment and telecommunications is higher in some Asian countries compared to the United States or Europe. Furthermore, the development of telecommunications is of paramount importance to the Chinese government, particularly in the context of its “Made in China” 2025 plan, under which the authorities aim to make China a leader in new technologies by 2025.

PC demand is expected to remain resilient with stronger demand for commercial PC than for consumer products. However, we tend to be cautious concerning PC demand because of the gradual easing of component supply and limited consumer spending post economic re-opening (we expect it for H2 2022). Chromebook (laptop or tablet with Linux-based Chrome OS operating system) shipments will decrease mainly in U.S. because of market saturation, but there is still room for some improvement in education-related Chromebook demand in Western Europe and Japan due to relatively low penetration rates. Despite the segment shortages, mainly for Power Management Integrated Circuit (PMIC) and networking card, servers’ shipments are expected to recover in 2022 driven by substantial spending outlook from major players and progressive optimism for chip offers. China’s server market will benefit from moderated spending due to regulatory concerns and economic recovery. In 2022, we expect a rise in data centre construction plans as more people work from home and that demand for these facilities and cloud computing services is increasing. South East Asia remains a key region in digital infrastructure and data centre transformation.

International race for innovation and regulatory development

The global race for innovation continues to focus on technological issues. The COVID-19 pandemic demonstrated the need for greater network performance, which could be partly provided by 5G. In this context, tensions between China and the United States are expected to persist under Biden’s administration, and might hinder electronic commerce and alter the deployment of 5G.

The restrictions imposed by the Trump administration are still in place, including on one of China's ICT leaders, Huawei (notably a leader in information structure), limiting its access to semiconductors. Huawei is no longer allowed to use American technology to produce components. Any use of American software or manufacturing equipment to produce objects via Huawei requires a license. Moreover, President Biden signed another legislation (“The Secure Equipment Act”) in 2021 to prevent companies (including Huawei) to receive equipment licenses from U.S. regulators. After dropping ‘WeChat’ and ‘TikTok’ bans, the Biden administration is reviewing app security recommendations.

As Internet access is growing and the digitalization of the global economy is continuing to expand, cyber risks exposure has inevitably increased across all industries. In this context, some economies are considering to adopt several projects in order to settle this issue. In this sense, the emerging markets present a higher risk of facing cyber-attacks.

The ongoing increase in data protection standards in important markets, such as Europe or North America, could affect the business models of the ICT giants and contribute to market fragmentation. Indeed, data protection rules could differ significantly from one State to another in the United States, for instance, as well as from one region of the world to another, while large ICT companies operate globally. Following criticisms accusing technology giants of contributing to the propagation of conspiracy theories, Facebook and Instagram, for instance, pre-empted the call, by blocking selected hashtags that were shared to spread misinformation.

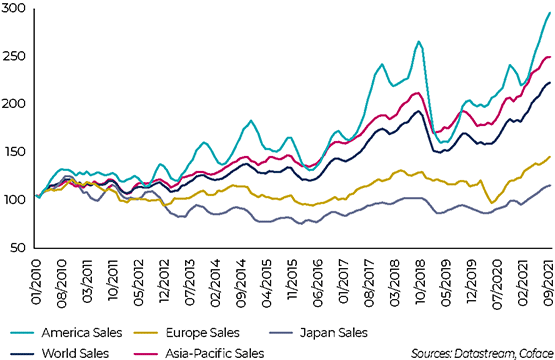

SEMICONDUCTORS SALES

Last update : February 2022