Strengths

- New methods of financing that share risks between producers and investors

- Efforts by oil companies to lower their breakeven point

- Diversification of large companies

- Renewable energies remain on a dynamic trend despite the crisis

Weaknesses

- High levels of debt, especially for companies exploiting non-conventional oils

- High volatility of crude oil prices

- Overcapacity of companies in the sector, and in the oil and gas services segment

- Strong pressure from environmental activists to reduce investments

Risk assessment

Risk Assessment

The reopening of economies has led economic activity to rebound. Coface anticipates a 4.1% global growth rate for 2022, after 5.6% in 2021. This will strengthen demand for energy, notably for oil related products used in the transportation sector. Coface forecasts Brent crude oil prices to average USD 75 in 2022, up from USD 71 the year before. This price recovery reverberates on the entire industry, but through heterogeneous effects on upstream and downstream oil activities.

Although the upstream segment benefits from price increases, downstream industries should suffer from higher acquisition costs of crude oil. Furthermore, refineries are having to deal with new standards, particularly environmental ones, and a subdued demand relative to pre-crisis levels. Increased competition due to the emergence of new refineries in the emerging world could also narrow the industry margins. Refinery operations are expected to recover during 2022, with disparities depending on geographical areas. The economic recovery depends both on countries’ exposure to the virus and on government responses aimed at stimulating the economy. Moreover, one must acknowledge that the recovery programmes are part of governments’ desire to foster a low-carbon economy, thereby promoting development of renewable energies an ownership of electric vehicles, an orientation that was already being pushed before the COVID-19 crisis. Therefore, this questions the sustainability of the hydrocarbon sector, particularly in North America, where unconventional players must now demonstrate (with difficulty) that their activity remains viable, while operating in a region where the energy sector has been dynamic in recent years.

Notes for the reader

LNG: Liquified Natural Gas

Bcf/d : Billion cubic feet per day

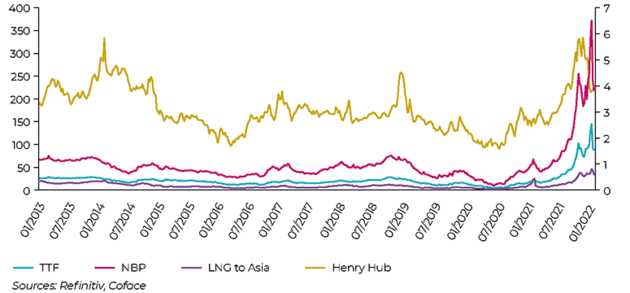

NATURAL GAS BENCHMARK PRICES EVOLUTION

Sector Economic Insights

COVID-19: a massive and lasting shock with a strong impact on an industry already weakened before the crisis

Lockdown measures, which remain (at least to some extent) in some countries, are affecting industrial activity and, above all, transport-based travels. However the reopening of economies has helped industrial activity and the transportation sector to rebound, even though variants’ apparition could impede the pace of demand growth.

A (full?) recovery for fossil fuels in all major markets worldwide

Oil consumption is set to increase during 2022 compared to 2021. The easing of restrictions will help demand to recover, thus pushing prices higher. As such, Coface expects the average price for 2022 to reach USD 75/barrel. Non OPEC+ producers were not able, during 2021, to meet demand with tailored additional supply, while OPEC+ countries barely attempted to fill the gap. Thus, as demand is robust, inventories are being excessively solicited and are now reaching lows (out of the last five years). This will help sustain higher crude prices in 2022.

Demand for travel is expected to gradually recover in 2022, thus pushing jet fuel consumption. The current situation bears some risks though, as the irruption of variants (ones that are more contagious for example) could hamper the reopening of international travel. Furthermore, households that are using their vehicle more will likely help diesel and gasoline demand. We are already witnessing this shift at the time of writing. The increase in electric vehicles in Europe and in China, through higher market shares, is a major event in 2021 and 2022. Electric vehicles in China and in Europe are subsidized via financial incentives, which make them affordable for some households. Furthermore, restrictive regulations in major cities in Western Europe are favouring newer, less polluting cars, such as electric vehicles. Even though the irruption of low emission vehicles will undoubtedly impact oil consumption, we expect global end demand, notably for refineries to be less impacted for the time being.

International travels will increase in 2022. The major unknown is the pace of recovery for business travels. The use of digital devices and applications during the lockdowns in 2020 and 2021 showed that business travels could be partly substituted by online meetings. Petrochemicals, via naphtha and liquid petroleum gases, will continue to grow, pushing demand for oil and natural gas related products. The capacity expansion underway in North America, in the Arabian peninsula and in Asia will support demand for such products. Some GCC countries are racing to diversify their economy and to help them reduce their dependence on oil. The Indian and Chinese governments are also enabling policies to be self-sufficient in large swathes of petrochemicals, through joint ventures with big national oil companies, such as ADNOC and Saudi Aramco and its subsidiary Sabic.

Natural gas prices have been higher during winter 2021-2022 (notably in Europe) due to lower temperatures, below average inventories and strong demand for liquefied natural gas (LNG), notably from Asian countries, but also from Brazil which is suffering from severe episode of droughts. The increase electricity generation from renewables has pushed demand for natural sources, as it is used for backup power plants. As such, TTF prices reached record levels in December 2021. Prices are expected to normalize during Q2 2022, but the pace of inventories replenishing should be monitored during spring and summer in the Northern hemisphere.

Coal, which is resurging - notably through higher prices, is benefitting from weather conditions across the Northern hemisphere and attempts to refill inventories, as experienced for natural gas. Consumption will continue to grow, notably in India and China, the world biggest consumers of this commodity. The increase in coal consumption in 2022 will put net zero pledges around the world at risk, but many emerging countries are betting on this commodity for their power generation sector.

Deep tensions in the power market

With natural gas and coal prices reaching new highs, the power market is facing deep risks. This is notably the case for regulated electricity retailers, which are suffering from high wholesale prices while having to sell their electricity to consumers at regulated and quite inelastic prices. In the UK, more than 25 retailers went into bankruptcy in 2021, putting their consumer base at risk. This situation will be exacerbated throughout winter 2021-2022 as gas inventories are very low in Europe, while demand for coal and gas is high in Asia, and geopolitical tensions are rising, notably between Ukraine and Russia.

Renewable energies expected to contribute to the reconfiguration of the sector in the near future

In line with the will of public opinion in a majority of countries, particularly in advanced economies, the transition to a low-carbon economy throughout the world, which is based in particular on energy transition, is challenging the fossil fuel industry. Stimulus plans in response to the COVID-19 crisis, which include environmental concerns, are expected to accelerate the reconfiguration of the sector, which had begun before the crisis. For instance, there are new regulations in the automotive sector in the main global markets (Asia, Europe, U.S.), whose players are developing models with a lower carbon footprint, as well as electric models, in order to avoid fines.

New Environmental, Social and Governance (ESG) standards exert additional pressure on oil and gas companies. Investors are increasingly more cautious towards the involvement of firms in the transition to carbon-neutrality and to the companies’ compliance to ESG norms. These changes could greatly affect the entire industry, increasing both capital and operating costs while also squeezing demand for oil products and their derivatives, in fine.

Ultimately, the drop in demand for plastic and the more systematic use of plastic recycling, thanks to changes in consumption habits and regulations (bottles marketed in the EU will have to contain at least 25% recycled plastic in 2025 and at least 30% in 2030), entails a drop in demand for refined oil (via naphtha).

While the development of renewable energies has slowed down because of the COVID-19 crisis, Coface expects the renewable energy segment to be more resilient than fossil fuels. Indeed, renewable energies have been growing in importance over the last 20 years, increasing from 21.8% of total global installed electrical capacity in 2000 to 34.7% in 2019, according to the International Renewable Energy Agency (IRENA). In 2020, over 80% of the added electricity capacity was renewable.

Last update : February 2022